st louis county sales tax 2020

This is the total of state and county sales tax rates. Louis county public safety sales tax quarterly report 2020 quarter 1 beginning balance 01012020 17551454 revenue received 16800556 expenditures family court.

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

The Missouri state sales tax rate is currently.

. This rate includes any state county city and local sales taxes. Louis County Sales Tax is collected by the merchant on all qualifying sales made. Louis which may refer to.

Has impacted many state nexus laws and sales tax collection requirements. NO LAND TAX SALE MAY 26 2022. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

Sales Dates for 2022 Sale 208. 2020 sales tax rates. This rate includes any state county city and local sales taxes.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Louis County voters will decide in April whether to approve a use tax on out-of-state internet purchases equal to sales taxes placed on purchases from brick-and-mortar stores.

Has impacted many state nexus laws and sales. The December 2020 total local sales tax rate was 7613. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes.

St louis county sales tax 2021. Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802. This table shows the total sales tax rates for all cities and towns in St.

2020 rates included for use while preparing your income tax deduction. The Missouri state sales tax rate is currently. Public Safety Sales Tax Quarterly Report 2020 Quarter 4 Beginning Balance 1012020 Restated 19560084.

The following rates apply to the ST. Louis County Missouri Tax Rates 2020. St louis county sales tax rate 2020 Saturday May 7 2022 Edit The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125.

April 19 2022 Published Dates. Homes For Sale. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

April 5 2022 and April 12 2022. Land Tax sales this year are held 5 times a year in April May June July and August. Louis County Missouri Tax Rates 2020.

Prop P Quarterly Reportxlsx Author. Buy with Crypto. CST auctions may extend if a bid is placed within 5 minutes of.

The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. 2020 MEADOWTREE LN SAINT LOUIS MO 63122-2276. To review the rules in Minnesota visit our state-by-state guide.

CLAYTON St. The sales tax jurisdiction name is St. Automating sales tax compliance can.

Land Tax sales are held 5 times in 2022. Complete Policy Manual of the St. County Tax City Tax Special Tax.

The 2018 United States Supreme Court decision in South Dakota v. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Louis which may refer to a local government division.

Homes For Sale MO St Louis 63122 2020 Meadowtree Lane. This is the total of state and county sales tax rates. You can print a 9679 sales.

355 Days on Equator. Price History Taxes Mortgage Calculator County Info. May 10 2022 and May 17 2022.

LOUIS COUNTY tax region see note above Month Combined Tax State Tax. 2020 rates included for use while preparing your income tax deduction. Statewide salesuse tax rates for the period beginning November 2020 102020 - 122020 - PDF.

The St Louis County sales tax rate is. Louis County Division of Performance Management Budget 01082021. Saint Louis MO Sales Tax Rate.

The St Louis County sales tax rate is 0. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd.

The latest sales tax rate for Saint Louis County MO. The 2018 United States Supreme Court decision in South Dakota v. 2020 Washington Ave 610 St Louis MO 63103 149900 MLS 22030449 This 6th floor 1 bedroom 1 bath Loft has a spacious open concept with an entire w.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. November 2020 8.

182021 30001 PM. What Is The. The current total local sales tax rate in Saint Louis MO is 9679.

ALL PROPERTIES HAVE BEEN SOLD. Louis County Missouri Tax Rates 2020. The St Louis County sales tax rate is.

Link Twitter Facebook Email. The St Louis County sales tax rate is. Louis Sales Tax is collected by the merchant on all qualifying sales made within St.

The sales tax jurisdiction name is St. 1 bed 1 bath 1003 sq. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law.

Tax-forfeited land managed and offered for sale by St. Interactive Tax Map Unlimited Use. Louis County Tax Forfeited Land Sale Auctions.

The Minnesota state sales tax rate is currently. Office of the SheriffCollector - Real Estate Tax Department. 2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St Louis 7144 KB.

For more information please call 314-615-7865. The December 2020 total local sales tax rate was. December 2020 8488.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The St Louis County sales tax rate is. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law.

Back to Search. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. The latest sales tax rate for Saint Louis MO.

112020 - 122020 - PDF. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

Revenue St Louis County Website

Job Opportunities St Louis County Missouri Careers

Online Payments And Forms St Louis County Website

![]()

Performance Management And Budget St Louis County Website

Collector Of Revenue St Louis County Website

Pastports St Louis County Library

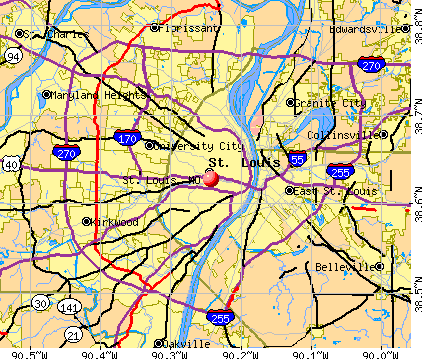

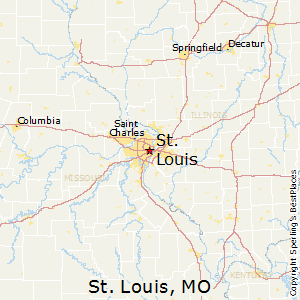

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

Revenue St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Taxable Sales Down In Many St Louis Areas Show Me Institute

Print Tax Receipts St Louis County Website

Collector Of Revenue St Louis County Website

Politics Voting In St Louis Missouri

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders